On February 17, 2023 AS Eco Baltia, the largest environmental and waste management group in the Baltics, issued 8 million EUR of its inaugural 3-year bonds with annual coupon rate 8%. Maturity date of the bonds is set on February 17, 2026 with an option for the issuer to call the bonds after 2 years.

Nominal value of each bond is 1,000 EUR. Bonds are issued at nominal value and minimum subscription amount for one investor was set at 10 bond units, or 10,000 EUR.

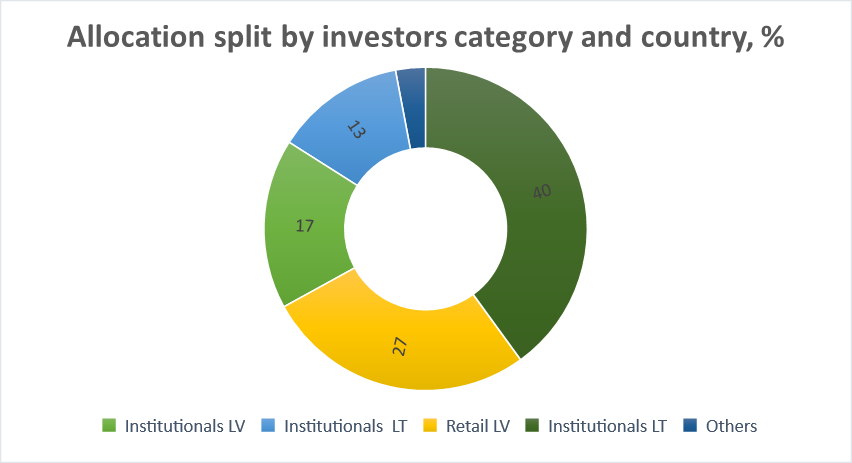

Subscription period of Eco Baltia’s bonds during public offering started on February 2, 2023 and ended on February 10, 2023. Issue was oversubscribed more than 3.5 times with orders from over 250 qualified and retail investors from Latvia and Lithuania. Total volume of received orders was 28.49 million EUR. Investors who placed the minimum order of 10,000 EUR were allocated in full, while bigger orders received partial allocations. Retail investors were very active in this transaction and were allocated 5.5 million EUR (69%) of the total issue with institutional investors making up the remaining 2.5 million EUR (31%). Most of the demand came from Latvian and Lithuanian investors with subscription amounts standing at 54% and 45% of total orders respectively.

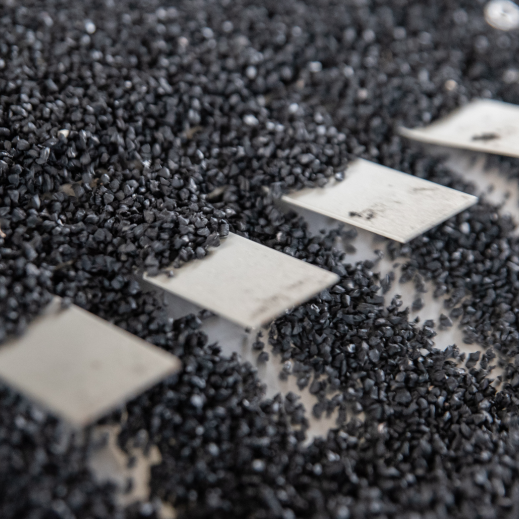

The proceeds raised from bond issue will be used to finance future development projects of Eco Baltia, with a focus on supporting the company’s expansion plans in Europe and promoting the circular economy. The Group is currently evaluating several acquisition opportunities. In addition, the company has several capital expenditure projects in its pipeline.

On February 8, 2023 company applied for listing the bonds at Nasdaq Riga alternative market First North and on February 9 Nasdaq Riga started the admission procedure. Sole Lead Manager of the transaction was Luminor Bank together with Šiaulių bankas acting as Co-Manager and Dealer. Transaction legal counsel and Certified Adviser is law firm TGS Baltic, and trustee – law firm Eversheds Sutherland Bitāns.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius