INVL Baltic Sea Growth Fund, leading private equity fund in the Baltic States, together with its portfolio company Eco Baltia, the largest waste management and recycling group in the Baltics, agreed to acquire a 70 percent stake in the largest Polish PVC windows recycler Metal-Plast.

The transaction is expected to close in Q4 2023, subject to receiving permission from the Polish Office of Competition and Consumer Protection as well as fulfilling other conditions precedent.

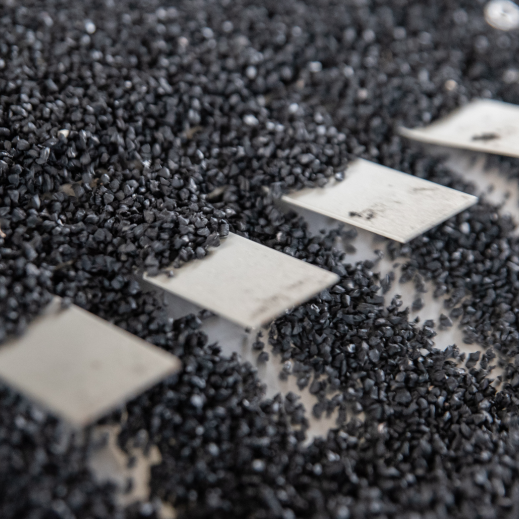

Metal-Plast has about EUR 34 million in annual revenues and employs about 200 people. The company is located in Świebodzice in the Lower Silesia province of Poland. It has current annual recycling capacities of 29,000 tonnes. From an environmental reporting perspective, 1 ton of recycled PVC saves 2 tons of CO2 emissions.

As part of the transaction. Mr. Sebastian Fedorowicz, Founder at Metal-Plast, will retain a 30% stake in the business. He added:

“Following 30 years of successful operations, Metal-Plast has become the leader of the Polish PVC recycling market. This strategic partnership with Eco Baltia and INVL Baltic Sea Growth Fund will now enable the company to pursue further growth opportunities.”

Janis Aizbalts, Head of Eco Baltia’s Environmental Services division, commented:

“Eco Baltia continues to grow and expand, not only in the Baltics but also internationally and Metal-Plast fits our internationalisation strategy very well. We now plan to develop Metal-Plast’s recycling capacities by 1.5x to 45,000 tonnes in a year, furthering our contribution to the evolution of circular economies.”

Vytautas Plunksnis, Partner at INVL Baltic Sea Growth Fund and Chairman of the Eco Baltia Supervisory Board, added:

“Metal-Plast represents the 8th portfolio investment of INVL Baltic Sea Growth Fund. The circular economy remains one of our core investment pillars and we are delighted to again partner with one of the most successful portfolio companies to date in Eco Baltia and Mr. Fedorowicz to further drive Metal-Plast’s exciting growth journey.”

The company will continue to be led by current CEO Mr. Grzegorz Jasinski. He concluded:

“I’m happy that Metal-Plast’s impressive recent track record attracted such strong investors who are well equipped with both capital and expertise to further support our growth in the PVC recycling market. A new wave of window replacement in both Poland and Germany is anticipated and the European Commission estimates that building renovation will be necessary for over 35 million residential buildings in the EU by 2030.”

Post transaction, Eco Baltia will own 42%, S. Fedorowicz 30% and INVL Baltic Sea Growth Fund 28% of the shares in Metal-Plast. INVL Baltic Sea Growth Fund owns a 52.8% stake in Eco Baltia, while 30.5% is owned by the European Bank for Reconstruction and Development. The remaining shares are owned by the management of the company.

Metal-Plast was advised by M&A advisor mInvestment Banking S.A. (part of mBank group) and law firm Ożóg Tomczykowski. Eco Baltia and the INVL Baltic Sea Growth Fund were advised by Wolf Theiss, Sorainen, and Deloitte.

In addition, INVL Baltic Sea Growth Fund’s investment period will end in 2024. As a result, the team has already launched a fundraising programme for its successor fund – INVL Private Equity Fund II. This will seek to attract EUR300 million as a target from investors. For full information, please visit: https://bsgf.invl.com/.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius