Eco Baltia’s second bond issue listed on the Nasdaq Baltic First North market

On 25 April, the second bond issued by the parent company of the largest environmental resource management and recycling group in the Baltics, AS Eco Baltia, was listed on the Nasdaq Baltic First North alternative market. As a result, the total value of the bonds listed by Eco Baltia on First North has now reached 18 million euros.

In addition to the EUR 8 million of unsecured Eco Baltia bonds already included in First North’s bond list, a further EUR 10 million of unsecured bonds with a nominal value of EUR 1,000 per bond, a fixed annual interest rate of 9% and a coupon payable twice a year have been added. The bonds mature on 2 November 2026.

“We are pleased that the stock exchange can be a successful tool for the development of companies in Latvia, as demonstrated by Eco Baltia’s second successful listing on the Baltic First North market. The capital market is open to entrepreneurs to increase the value of their business through alternative financing. We wish Eco Baltia every success in its future growth,” said Liene Dubava, Head of Nasdaq Riga.

The inclusion of Eco Baltia’s bonds in First North follows a private placement to Latvian, Estonian and Lithuanian investors in November last year. Total demand for the bonds exceeded the offer by more than 1.7 times and attracted more than 100 private and institutional investors.

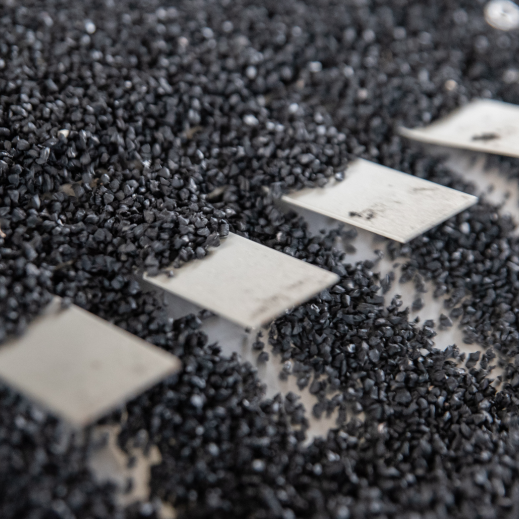

“We are grateful to our investors for the confidence they have shown in the Group’s growth. In recent years, we have been able to implement significant activities to develop Eco Baltia in the international market. We have achieved the Group’s expansion not only in the domestic market, but also through acquisitions in Lithuania and the Czech Republic. The funds raised from investors have also helped us to develop the Polish market, where last year we acquired a 70% stake in Metal-Plast, Poland’s largest processor of PVC window and door profiles, together with one of our shareholders, INVL Baltic Sea Growth Fund, a private equity fund in the Baltic States. We continue to work on Eco Baltia’s strategic development goals to increase our contribution to the development of the circular economy internationally,” says Māris Simanovičs, Chairman of the Board of Eco Baltia.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius