AS Eco Baltia, the largest environmental and waste management group in the Baltics, invites to join the webinar about company’s inaugural 3-year bond issue public offering. Webinar will take place on February 7 at 2pm. The webinar will be open to all registrees signed up through the link below.

Webinar will be hosted by the Chairman of the Management Board Māris Simanovičs and Member of the Management Board and CFO Santa Spūle. Additional information about the upcoming bond offering will be provided by Gints Belēvičs, the Head of Markets Customers in Luminor Bank, the Sole Lead Manager of the transaction. During the webinar attendees will be introduced with Eco Baltia’s business segments, growth story, its development plans, as well as the details of the public bond offering.

To sign up for the webinar, please use the following link: https://nasdaq.zoom.us/webinar/register/WN_l8ws-NSWSzGAp_POsa_-lQ. After filling in the application, attendees will receive a link to the webinar and instructions to their e-mail. When connecting to the Zoom webinar for the first time, you will be asked to download the app.

Webinar will be held in English. After the presentation, a question and answer session will take place. Attendees are welcome to send their questions about the company until February 6 to the e-mail ieva.unda@nasdaq.com or submit them through the registration link below.

“Eco Baltia” in its inaugural bond issue seeks to issue up to 8 million EUR of unsecured fixed-rate bonds. The maturity of the bonds is set at 3 years. Interest rate (coupon) of the bonds will be fixed for the whole period and will be set within the range of 8% to 9% upon expiration of the subscription period. Subscription period will end on the 10th of February. The bonds may be subscribed by qualified investors and retail investors. Nominal value of each bond is 1,000 EUR. Minimum subscription amount for one investor is set at 10 bond units, or 10,000 EUR. Application will be made for listing the bonds at Nasdaq Riga alternative market First North within 6 months upon issue.

All information about the bond issue and subscription process is provided in the Offering Document and Final Terms which can be found on Eco Baltia’s website www.ecobaltia.lv section “Investors”.

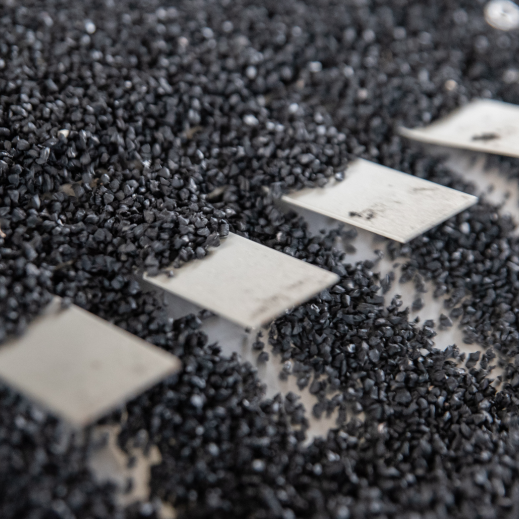

The financing raised in the bond issue is intended to be used for future development projects of Eco Baltia aimed to support further expansion at the European level and promote circular economy.

The information contained in this announcement does not constitute investment advice nor a proposal. The information in this announcement contains generic forward-looking statements and the intention of Eco Baltia to undertake a public offering. Any investment decision shall be made subject to the offering document, which is available at the Company’s website www.ecobaltia.lvsection “Investors”.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius