The largest environmental resource management group in the Baltic States, Eco Baltia AS, has successfully completed its second three-year EUR 10 million bond issue. The issue, which was conducted as a private placement, once again attracted strong investor interest, with total demand exceeding the issue size by amounting to 1.7 times. Orders were received from more than 100 institutional and retail investors in Latvia, Estonia and Lithuania.

“After the second Eco Baltia bond issue, we also see that investor activity is high. This confirms the investors’ long-term vision for the development of the company and the entire environmental resource management segment, in which we are expanding our international presence. The investments made will help us to take the next steps in the further growth of the group and contribute to the promotion of the circular economy, which is becoming increasingly important worldwide, in line with the European Union environmental policy cornerstones,”says Māris Simanovičs, Chairman of the Board of Eco Baltia.

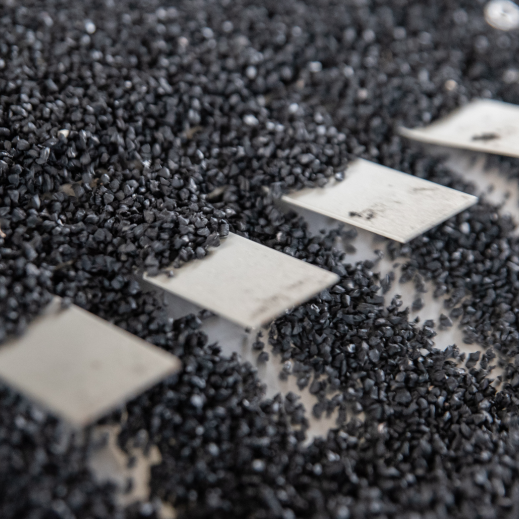

The proceeds of the issue will be used to further the company’s development strategies through the acquisition of new companies. The acquisition of Metal-Plast, Poland’s largest PVC window recycler, is currently under consideration and will further expand Eco Baltia’s presence on the international market.

“Our goal is to rapidly accelerate Eco Baltia’s growth and further strengthen its position in the international market. Experience in the capital market has shown us that attracting investment is one of the tools to achieve this. And this second bond issue shows us that we are on the right track in Eco Baltia’s development,” says Santa Spūle, Eco Baltia Board Member and CFO.

The minimum subscription amount per investor was EUR 100 thousand. The total demand for bonds at the end of the placement period was almost EUR 17 million, 1.7 times the maximum planned issue size. Investors subscribing to the minimum investment amount of EUR 100,000 received full allocation, while the larger orders were partially satisfied given the high level of investor interest.

The highest interest in Eco Baltia’s bond issue came from retail investors, who were allocated 90% of the issued bonds, while institutional investors received 10% allocation.

The coupon rate of Eco Baltia’s second bond issue was set at 9% per annum. The bonds have a maturity of three years (2 November 2026), but the issuer has the right to redeem the bonds prematurely after two years.

“Eco Baltia’s strategic development, financial performance and business model are in line with capital market guidelines, as demonstrated by yet another successful bond issue. As a long-standing client, Eco Baltia has proven to be a stable and growth-oriented company. This has also been recognised by investors. We are grateful to have been involved in this transaction for the second time and to have contributed to the development of Latvia’s leading environmental resource management company,” said Gints Belēvičs, Head of Markets in Luminor Bank.

The bonds are expected to be listed on Nasdaq Riga’s First North alternative market within six months of the issuance. The arranger of Eco Baltia bond issue is Luminor Bank, one of the leading financial service providers in the Baltic States, and the distributor is Šiaulių bankas. COBALT is the certified advisor, while Eversheds Sutherland Bitāns is the bondholders’ trustee.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius