In order to promote faster development of polyethylene terephthalate (PET) bottle recycling and facilitate an increase in production capacity, Kaspars Ezernieks has joined the management team of the PET bottle recycling company, JSC PET Baltija, which is part of the largest and fastest-growing environmental resource management and recycling group of companies in the Baltics, JSC Eco Baltia. He has taken on the role of Board Member and CEO.

As a Board Member and CEO of the JSC PET Baltija, K. Ezernieks will be responsible for the operational activities of the company in accordance with the Group’s strategic objectives. Mr Ezernieks will also take care of successful relocation of the existing PET Baltija’s production facility to the new premises in Olaine, implementation of the LEAN culture and the execution of plans, as well as other responsibilities for the company’s operations and development. Previously, K. Ezernieks spent thirteen years in executive positions, including at the company Stora Enso, a leading renewable products packaging, biomaterials, wood construction, and paper manufacturer and supplier, where he held the position of Director at the Latvian-based manufacturing facility in Launkalne.

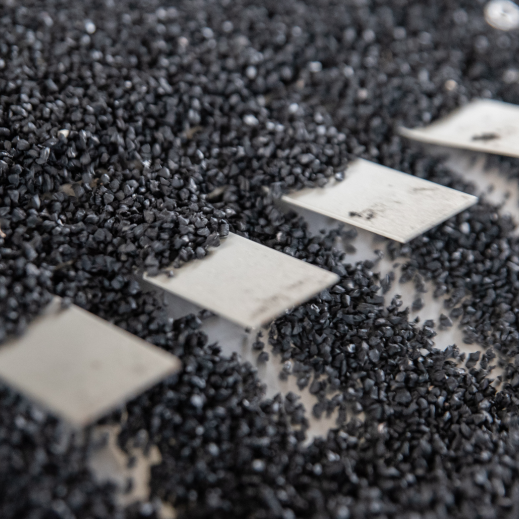

Mr Māris Simanovičs, Chairman of the Board of Eco Baltia: “PET Baltija has experienced rapid growth in recent years. Despite the challenges on the international market related to the global geopolitical situation, PET Baltija achieved the highest turnover last year. Last year, we launched one of the most influential investment projects in the company’s history, aimed at increasing PET pellet production capacity. The project involves work on gradual relocation of the current plant in Jelgava to a building currently under construction in Olaine, which will be one of the largest indoor production facilities in Latvia and PET bottle recycling plants in Northern Europe. The next steps in the company’s development, especially in these challenging times, require additional competences and approaches in various business processes, so we see the accession of the PET Baltija’s management as a huge gain on the way of achievement of our goals.”

As far as the development of the JSC PET Baltija is concerned, this year, we are planning to invest in improvement of the company’s processes and increase of efficiency, including new technologies, as well as improvement of the existing technologies, which will provide a possibility to recycle an even higher proportion of recyclable PET materials, with the largest possible share being returned to the re-circulation. This year, the company will also continue its work on the implementation of quality standards to ensure and certify food-grade material, as well contribute to increasing production volume by providing the right quality and quantity of recycled raw materials to meet the needs of potential customers.

“Since our entry the company has not only doubled in size, but became truly international. We strongly believe that the key to unlocking the full potential of the company is strong management which can devote full attention, on the one hand to strategical growth and development to continue its development and staying competitive and on the other to managing day to day operational activities to excel at efficiency and client satisfaction. Kaspars joining the team will allow to separate the strategical and operational management in the team with the goal to achieve sustainable future growth,” says Deimante Korsakaite, Partner at INVL Baltic Sea Growth Fund, Chairperson of the Supervisory Board of the JSC PET Baltija and Member of the Supervisory Board of the JSC Eco Baltia.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius