INVL Baltic Sea Growth Fund (“the Fund”), the largest private equity investment fund in the Baltic region, has completed the acquisition of a controlling stake (52.81%) in Eco Baltia, the largest environmental management group for plastic recycling and waste collection in the Baltics.

The deal sees the European Bank for Reconstruction and Development (“EBRD”) retain their 30.51% stake in Eco Baltia and Maris Simanovičs, Chairman of the Management board of SIA Eco Baltia grupa, retain a 16.68% stake (via Penvi Investment Ltd). Both parties have subsequently entered into a shareholders’ agreement with the Fund.

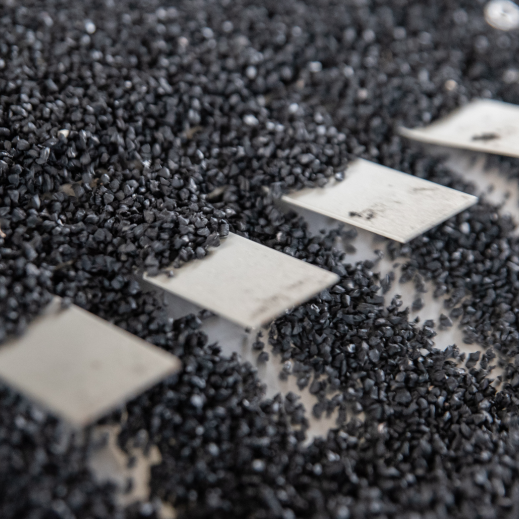

Vytautas Plunksnis, Partner at the Fund, commented: “We plan to invest significant capital into Eco Baltia’s recycling capabilities and establish it as a clear market leader of the circular economy in the Baltic region, through the delivery of high quality and sustainable recycling services. The world we live in is now using more resources than the planet can produce and so reusing what we have in a sustainable manner is of critical importance. We intend to focus on food grade recycled plastics (rPET) capacities expansion that will ultimately contribute to a reduction in carbon footprint and promote environmental sustainability.”

In 2019, Eco Baltia’s group revenues increased by 9% to €70.62 million, with more than 60% of its revenues coming from the recycling sector alone. The group employs more than 800 people and its largest subsidiaries are PET Baltia, Eco Baltia Vide, Nordic Plast and Latvijas Zalais Punkts respectively.

Two Partners at the INVL Baltic Sea Growth Fund, Vytautas Plunksnis and Deimantė Korsakaitė will join Eco Baltia’s supervisory board together with an independent member and waste management expert, Jurgita Petrauskienė. The EBRD will be represented by Peter Hjelt and Maris Simanovičs by Gints Pucens.

Deimantė Korsakaitė, Executive Partner at the Fund, commented: “Investing in proven, leading Baltic companies which clearly demonstrate further growth potential is one of the Fund’s core investment themes. Eco Baltia sits at the forefront of the circular economy for the Baltic region and therefore meets this criterion. This deal represents the third company to join our portfolio and will allow us to capitalise on the growing importance of environmental concerns by focusing on both recycling and lifestyle sustainability enhancement measures.”

Ian Brown, Head of Baltics at the EBRD, commented: “We are excited to support a leading private equity fund in the Baltics and growing Eco Baltia as we seek to create real value in an ever more important circular economy model.”

Maris Simanovičs, Chairman of the Management board of SIA Eco Baltia grupa, commented: “We are pleased to attract such a major Baltic investor like the INVL Baltic Sea Growth Fund. With this new direction for the company, we look forward to a growth phase that will doubtless open up fresh opportunities and key markets globally for the group. This internationalisation is particularly important for the waste recycling industry in order to partner and work with major international companies and to further expand our Eco Baltia network worldwide.”

INVL Baltic Sea Growth Fund

INVL Baltic Sea Growth Fund with its total size of €165mn is the largest private equity fund in the Baltics with the European Investment Fund (“EIF”) acting as its anchor investor.

The EIF has committed €30mn with the support of the European Fund for Strategic Investments, a key element of the Investment Plan for Europe (or the ‘Junker Plan’), as well as allocating resources from the Baltic Innovation Fund, the “fund of funds” initiative developed in cooperation with the governments of Lithuania, Latvia and Estonia. This aims to increase capital investment in high growth potential small and medium-sized enterprises in the Baltic States.

The Fund seeks to assemble a diversified portfolio of companies, targeting majority or significant minority stake deals and writing tickets of €10mn to €30mn, that showcase high growth potential and the ability to compete on a truly global basis.

The Fund is focused on the Baltic States and the neighbouring regions of Poland, Scandinavia and Central Europe specifically. The Fund so far has invested in two companies within the healthcare and civil engineering sectors.

The Fund is managed by one of Lithuania’s leading asset management companies INVL Asset Management, which is part of the Invalda INVL group.

INVL Asset Management is part of the Invalda INVL, one of the leading asset management groups in the Baltic region. The group’s companies manage pension and mutual funds, alternative investments, individual portfolios, private equity assets, and other financial instruments.

Over 200,000 clients in Lithuania and Latvia and international investors at the end of 2019 have entrusted the group with more than €1bn of assets under management. Active since 1991 and with a solid track record, Invalda INVL boasts 28 years’ worth of experience in managing private equity assets in the Baltic countries and CEE landscape while developing companies into best-in-class market leaders.

.

.

.

.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius