Eco Baltia plans to acquire Eko Osta, a company that collects and recycles hazardous waste

Expanding the company’s activities and range of environmental services, the largest environmental resource management and recycling company in the Baltics, JSC (AS) Eco Baltiaplans to acquire Eko Osta Ltd. (SIA), Latvia’s leading collection and recycling company for environmentally harmful and hazardous waste. The purchase agreement concluded by the parties, which requires merger authorisation from the Latvian Competition Council (CC), provides for the acquisition of 100% of the shares in Eko Osta.

With the conclusion of the transaction, Eko Osta will become one of the companies in the environmental management sector of the Eco Baltia group, specialising in the management of hazardous and environmentally harmful waste. At the same time, it should be stressed that no changes are planned to the existing cooperation agreements and arrangements for both parties’ clients, partners and employees.

Mr Māris Simanovičs, Chairman of the Board of Eco Baltia: “In recent years, we have significantly expanded Eco Baltia’s areas of activity, strengthening our market position internationally as a full-cycle environmental resource manager. The inclusion of the environmentally harmful and hazardous waste collection and recycling company in the Eco Baltia Group is a significant step towards even faster development, covering an even more diverse waste stream to be recycled. The deal will ensure better collection and circulation of waste in segments where compliance with national standards has so far been difficult. This will benefit both the customers of the group company Latvijas Zaļais punkts in terms of meeting their environmentally harmful waste collection targets, and the country as a whole in meeting its recycling targets more successfully.“

Eko Osta will continue to cooperate with other participants in the producer responsibility system, promoting faster compliance with the national hazardous waste collection and recycling standards.

Andrejs Laškovs, the current shareholder of Eko Osta: “Eko Osta has been providing specific waste management and other services in Latvia for more than 20 years. This requires a special approach and precision in all company processes, ensuring that services are delivered to the highest environmental standards and to an excellent quality. As the environmental management sector develops not only nationally, but also internationally, we see great potential for growth in Eco Baltia’s portfolio of companies. This will benefit for both, the partners, customers and employees of Eko Osta, as well as the country as a whole, by contributing to a comprehensive reduction of negative environmental impacts.”

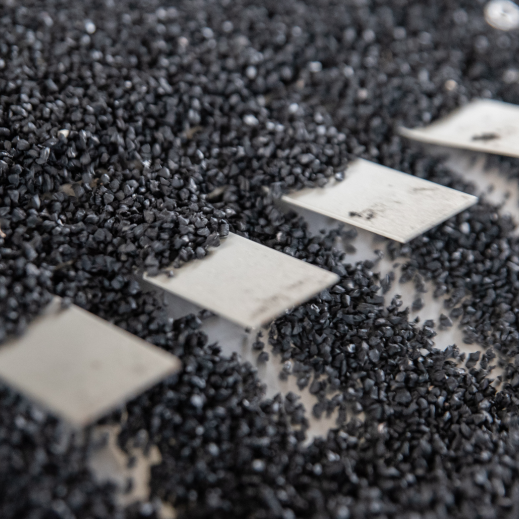

Eko Osta is engaged in the collection, transportation by floating and land vehicles, treatment and recycling of petroleum-contaminated water and soil, recycled lubricating oils, organic solvents, used oil filters and tyres, as well as geological, hydrogeological, geoecological and geotechnical research, environmental quality monitoring and environmental remediation. Eko Osta employs around 70 people and had a turnover of EUR 7.79 million in 2023.

Jānis Aizbalts, Head of Environmental Management, Eco Baltia Group: “Eco Baltia has experienced rapid development in the environmental sector in recent years. This included covering larger waste management regions and types of materials, as well as the development of recycled materials sorting in Latvia and Lithuania. Last year, we also expanded into urban environmental management, where the Group’s environmental company Eco Baltia vide has more than a decade of experience. The addition of Eko Osta to Eco Baltia’s existing portfolio allows us to take even greater steps to promote the circular economy in the country, while strengthening our market position as a full-cycle waste management and recycling group.“

The acquisition of the company is planned to be carried out through Eco Baltia’s subsidiary Latvijas Zaļais punkts. Financing of the transaction is planned by attracting bank funding, and the parties have agreed not to disclose the amount of the transaction publicly.

20.03.2024.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius