Eco Baltia publishes its first ESG report in line with EU CSRD / ESRS requirements

The largest environmental resource management and recycling group in the Baltics, Eco Baltia, has published its first non-financial report on the implementation of environmental, social responsibility, and corporate governance (ESG) principles. The report has been prepared in accordance with the European Union’s Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS).

The report has been developed to highlight Eco Baltia’s achievements and initiatives in the fields of sustainability, social responsibility, and corporate governance, presenting them to clients, employees, investors, shareholders, and the wider public.

Key results in 2024

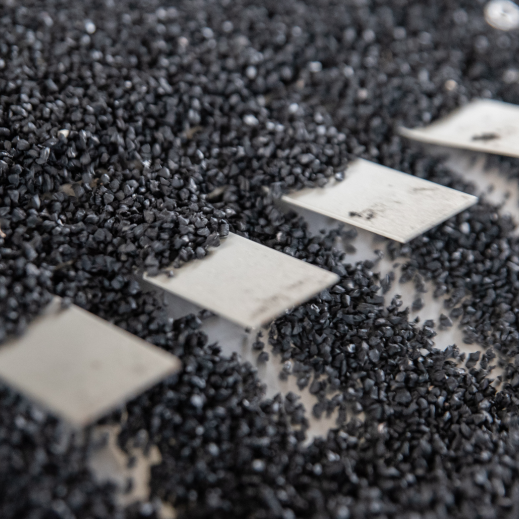

In 2024, Eco Baltia processed more than 250,000 tonnes of materials across its 30 facilities in Latvia, Lithuania, Poland, and the Czech Republic, making a significant contribution to the development of the circular economy and reducing the use of natural resources. The company further expanded its waste sorting infrastructure by investing €11.7 million in the Resource Management Centre in Latvia and €18 million in the reconstruction of the sorting centre in Vilnius, Lithuania, while also ensuring high environmental and fire safety standards in these facilities.

A particularly important step was the €39+ million investment in the PET recycling plant ITERUM, of which around €14 million was invested by the company itself. ITERUM is one of the largest facilities of its kind in Northern Europe, significantly expanding opportunities for reusing recycled PET materials in international markets.

At the same time, Eco Baltia advanced other sustainability initiatives. By 2024, 18.5% of all waste collection in the Baltics was carried out using low-emission vehicles, with the share in Latvia reaching as high as 63%. In addition, under the EU LIFE project, a polymer material testing laboratory was established at the Nordic Plast facility, supporting and promoting the use of recyclable materials in packaging.

Altogether, through these initiatives and solutions, Eco Baltia prevents around six times more CO₂ emissions than it generates, reinforcing its role as one of the leaders in circular economy and sustainable solutions in the Baltics and across Europe.

Māris Simanovičs, Chairman of the Board of Eco Baltia:

“Sustainable development is not just an obligation – it is the foundation of our competitiveness and growth. Our goal is to stay one step ahead – not only by meeting regulatory requirements but also by creating new solutions in circular economy and sustainable corporate governance. This ESG report is proof that we can successfully combine business growth with responsibility towards society and the environment.”

The full ESG report is available HERE.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius