The largest environmental resource management group in the Baltics, JSC (AS) Eco Baltia, closed the first nine months of 2023 with a turnover of EUR 161.1 million, 4% up compared to EUR 154.9 million in the first nine months of 2022. Increase in turnover was mainly driven by acquisition of new companies, as well as a solid performance in the environmental management sector. Whereas, EBITDA of Eco Baltia reached 19.2 million (EUR 17.9 million in the first nine months of 2022).

Mr Māris Simanovičs, Chairman of the Board of the Eco Baltia: “We have continued to grow in the first nine months of the year, both through organic growth and acquisitions. We have increased our market both in Latvia and internationally. This year’s success is also reflected in the TOP 101 list of Latvia’s most valuable companies, where we have risen seven places in just one year. The first nine months were also notable for the broad investor interest in Eco Baltia’s bonds, which were listed on the First North alternative market. This allows us to plan the broader development of the group.”

Earlier this year, Eco Baltia issued its first bonds worth EUR 8 million, with investor demand exceeding the maximum amount of offer 3.5 times. The bonds mature on 17 February 2026, with an option for the issuer to retire the bonds after two years. The bonds are listed on the Nasdaq Baltic Alternative Market “First North” from 2 March 2023. After the reporting period, Eco Baltia issued bonds for a second time – EUR 10 million for three years. Again, investor demand was strong, exceeding supply by 1.7 times.

Along with the acquisitions completed last year, work has continued in the first nine months of this year to evaluate new business lines and acquisitions, further strengthening Eco Baltia’s position and market share both in Latvia and internationally, while developing and expanding the full-cycle waste circulation in the overall service portfolio. Work has also been carried out, and will continue in the coming years, on the modernisation and digitalisation of various processes within the company.

At the beginning of 2023, Eco Baltia’s largest environmental segment company, Eco Baltia vide, through its subsidiary, producer responsibility system operator Latvijas Zaļais punkts, concluded a deal to acquire the street and road maintenance company Pilsētas Eko Serviss. The transaction resulted in the acquisition of 100% of capital shares in companies Pilsētas Eko Serviss, PES serviss and B 124, which were merged into Eco Baltia vide as of 1 December. Eco Baltia vide and Ecoservice continued work on the development of several projects, including the construction debris sorting site, as well as the sorting of household waste, textiles and other materials.

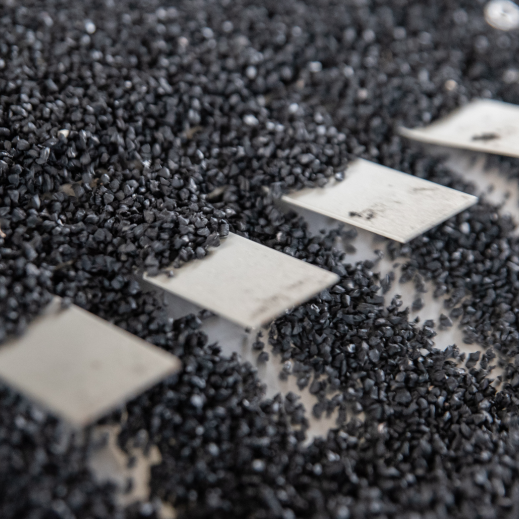

Eco Baltia Group’s polymer recycling company Nordic Plast has completed the testing of its new plastic sorting and recycling line. More than EUR 2.8 million was invested in its development last year, with the aim of increasing production capacity by up to 30% over time.

Whereas, the recycler of PET bottles, PET Baltija, continues work on the development of its new production plant in Olaine, where the company will invest a total of more than EUR 10 million in production equipment. The new plant is scheduled to be fully operational next year, tripling PET production capacity. In order to facilitate even faster development of PET Baltija and implementation of investment projects, changes have been made in the composition of the Management Board: in July, Mr Kaspars Ezernieks, CEO of PET Baltija, became a Member of the Management Board, while, from 11 September, Ms Jūlija Zandersone joined the PET Baltija management team as the Chairperson of the Management Board, meanwhile also holding the position of Head of the Recycling Sector at Eco Baltia Group.

Since the business model and activities of Eco Baltia companies are focused on the implementation of the principles of circular economy through various sustainable business practices, active work continued on the development and implementation of a consolidated ESG (environmental, social and governance) strategy, as well as on the creation of an effective internal environment, marked by the status of the national programme “Family Friendly Workplace” implemented by the Society Integration Foundation.

Eco Baltia’s main objectives are to improve working conditions, support employees, ensure the highest level of occupational safety and improve ESG and sustainability by continuing to invest in the recycling sector and waste and environmental management. The plan is to gradually start production at the new PET Baltija production plant, tripling PET production over time, and to foster synergies between the Group’s companies to maximise the benefits of full-cycle waste management.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius