“Eco Baltia” continues growth in the first nine months of 2025 – turnover reaches EUR 214 million

Eco Baltia, the largest environmental resource management and recycling group in the Baltics, increased its net turnover to EUR 214.03 million in the first nine months of 2025, which is 11.4% more than in the same period last year. This growth was ensured by targeted performance in the group’s core business lines — environmental management services and recycling — through consistently increasing productivity, automation levels, and process efficiency.

Strategic development directions

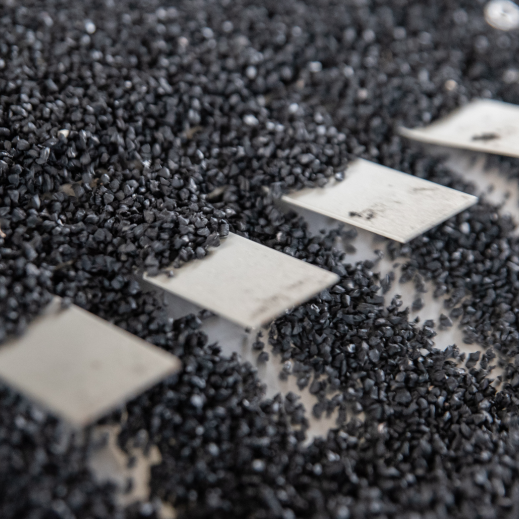

During the reporting period, investments in waste management infrastructure and technologies were maintained to increase sorting and recycling capacities, improve the quality of secondary raw materials and enhance competitiveness in the Baltic region and other export markets. The requirements of the European market further reinforce this focus, as technological modernisation is becoming a key prerequisite for sustainable growth.

During the first nine months of 2025, Eco Baltia continued to expand its environmental management services and strengthen its presence in various regions. This was facilitated by the group’s companies participating in tenders, including in the Ādaži region. Following its success, Eco Baltia vide’s contract with the local government provides for the provision of services over a seven-year period, with a projected volume of EUR 22 million (excluding VAT). At the same time, specialized services for specific waste streams have also been developed, such as construction waste, textiles and PVC materials – which allows for more efficient collection and processing, as well as offering customers a more complete range of solutions alongside everyday household waste management.

Considering the challenging conditions in the European recycled polymer market, Eco Baltia continued to expand its sales in foreign markets, as well as improve its operational performance with cost optimization and increased production efficiency, which allows it to maintain its competitiveness in the challenging market conditions.

Māris Simanovičs, Chairman of the Management Board of “Eco Baltia”:

“In 2025 we have maintained a stable growth rate based on investments in sorting and recycling capacities, a well-considered cost policy and higher operational performance, expanding our presence in the Baltic markets. Our priority is sustainable growth, creating greater added value throughout the circular economy chain. This strengthens competitiveness and forms a stable foundation for long-term development.”

At the same time, “Eco Baltia” continued to strengthen its corporate standards and sustainability management system by introducing a unified approach to ESG issues, risk management and regular, transparent communication with partners, clients and investors. Sustainability goals are becoming an integral part of business development – they are closely linked to more efficient use of resources, modernisation projects and compliance with requirements that often determine competitiveness in the European market.

Vytautas Plunksnis

Vytautas Plunksnis  Deimantė Korsakaitė

Deimantė Korsakaitė  Alberto Atienza Güell

Alberto Atienza Güell  Jurgita Petrauskienė

Jurgita Petrauskienė  Gints Pucēns

Gints Pucēns  Algimantas Markauskas

Algimantas Markauskas  Māris Simanovičs

Māris Simanovičs  Santa Spūle

Santa Spūle  Sigita Namatēva

Sigita Namatēva  Saulius Budrevičius

Saulius Budrevičius